Why mega-deals are dominating Australia’s property market

Large-scale tower transactions increase dramatically as investors hunt yield.

The size of commercial real estate deals is on the rise in Australia, as property owners cash out of the country’s office sector after years of strong growth.

So-called mega-deals -- those valued AU$400 million or over -- have dominated the market, with 14 in total last year, compared to eight in 2018 and three in 2017, according to JLL data.

The surge is due to sellers taking advantage of remarkable capital value growth in the office sector. Prime asset values have grown by 14.5 percent per year in Sydney’s business district over the past five years, and 11.5 percent nationally.

“We’ve had really strong growth for the past 10 years in Australia’s office sector, but this is the first time transactions have surpassed the AU$20 billion mark,” says Rob Sewell, head of office investments, JLL. “Investors continue to put their capital here because of the transparency, fixed escalations in leases and low volatility of returns relative to other mature office markets.”

There are other reasons as well. The record low cost of debt is providing liquidity for investors to aim for bigger deals, while overseas investors are increasingly looking at the market because of the weak Australian Dollar and pressure to diversify by geography and asset class.

“We’ve never before seen such a diversity of capital sources flood into Australia. This includes A-REITs, unlisted funds and a range of international capital,” says Sewell.

Link REIT’s acquisition of 100 Market Street, Sydney, for $683m, struck at an initial yield of 3.97 percent, was the largest purchase in Australia by a Hong Kong buyer, and the REIT’s first acquisition outside of Hong Kong or China.

Joint ventures with Singapore’s GIC and Australian property group Charter Hall, plus U.S. group Starwood and Australia’s Arrow Capital, show how overseas investors are teaming up with local players to allow them to move more swiftly and knowledgably, Sewell says.

The role of debt

Offshore investors accounted for 41 percent of office transactions in Australia by value in 2019. This share is likely to grow as investors use greater leverage.

“Overseas investors are more used to using leverage as part of their acquisition structure and so they are going to have an advantage in buying real estate at fairly tight pricing over their domestic counterparts,” Sewell says. “They’re using 50 to 60 percent leverage, whereas most of our Australian core investors tend to use no more than 20 percent to 30 percent.”

In a tight market, the availability of stock will continue to be a challenge, though Sewell believes new pricing benchmarks will encourage more property owners to part with their assets.

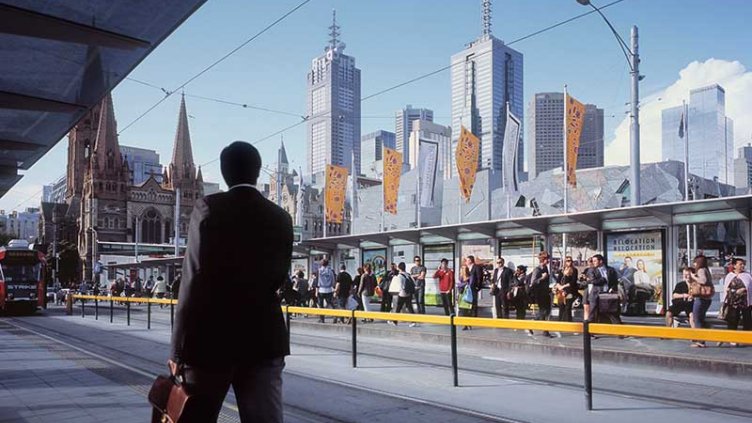

And there will be more activity beyond the familiar hubs of Sydney and Melbourne as investors search for yield.

Yields in Sydney and Melbourne (at 4.50 percent and 4.75 percent respectively for prime offices) are the tightest they have ever been as investors flood the real estate market with capital, with limited available stock to buy.

Sydney and Melbourne’s fringe office markets, as well as Canberra and Adelaide in particular will be in the frame.

“2020 will be the year we find out just how far investors are willing to go with regard to yields,” says Sewell. “At 100 Market Street we’ve proved up 4 percent. Will investors be prepared to go past that?”